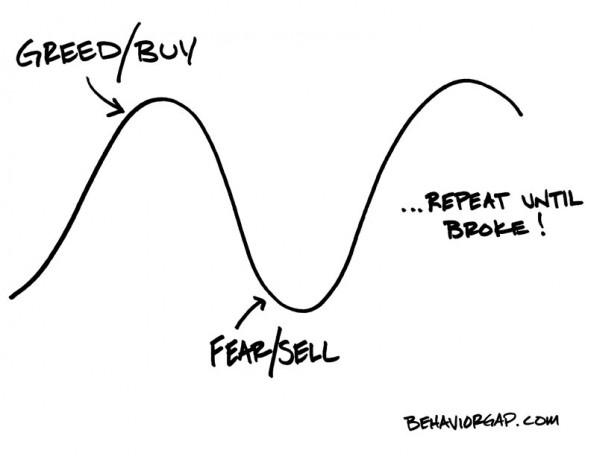

If you speak with any experienced investor they will tell you that the two main characteristics of the stock market are fear and greed. These are the main drivers behind share price movements and despite the risks, investors keep clinging onto these drivers. So, in what way do fear and greed rule investment markets?

The fear of missing out

If we look at the US market there were many analysts calling a new downtrend once Donald Trump was elected the president of the USA. They believed this was the beginning of a major problem for the US economy and there were concerns about overseas relationships. However, the US stock market continues to go from strength to strength and is just off its all-time high on the back of a “Trump rally”.

Slowly but surely many of the analysts who called a downtrend for the US market have begun to change their minds and go with the momentum. You only need to look at the press to see the number of analyst changing their views having been caught short as the market moved higher – fearing further upside. This “catch-up” has probably pushed the market too far in the short term but perfectly illustrates the fear of missing out.

Greedy investors get burned

There are many examples where investors are determined to squeeze every last cent out of their profitable investments. They watch the share price go higher and higher, knowing it is overstretched on the upside, and when there is a short-term correction they kick themselves because they did not sell on the way up. Fear and greed are human emotions but to make a significant long-term return on investments you need to know when to take a profit and when to sit back.

We have all been there, a share we hold is going higher and higher all the time and there seems to be nothing but good news on the horizon. It is very easy to get blinkered and as other short-term investors join the party it can seem as if the only way is up. As soon as emotions become involved in your investment decisions this can be the beginning of the end. Stay calm, look at the figures, are the shares really overbought and would you feel more comfortable taking a profit? Simple questions, but how many of us ask ourselves these questions when our shares are moving higher?

The emotional premium

While some would call it “investor sentiment” to all intents and purposes there is an emotional premium to stock market share prices. If investors are positive then this will add a margin to share prices quite simply because of the feelgood factor. If investors are more cautious, as they were in light of Brexit in the UK, share prices will lose this emotional premium and very often go towards a “discounted price” in relation to the immediate outlook. It is possible to play the emotional premium if you get your timing right and you are not too greedy.

Trading on the “emotional premium” is an art in itself but very often it means going against the trend, going short on shares which are moving too high too quickly, and buying shares which have fallen too far too quickly. If you look at share price movements on a regular basis you will begin to see what we mean!