After the S&P 500 Stock Index posted its largest one-day fall since February, much focus is back on computer trading programs. These computer generated programs react to market movements buying and selling stock, in large amounts, in a split second. In many ways they can exacerbate the situation on the upside and the downside as similar programs react at the same time.

A staggering $1.5 trillion under management

An academic paper back in 2017 highlighted the growing issue of risk parity funds, volatility targeting funds and trend followers. Amid suggestions that $1.5 trillion of investment funds is effectively under the control of “computer trading programs” it is not difficult to see the potential issues. If sale programs are undertaken at the same time then a partial sell-off can lead to more stock sales, falling share prices and the vicious circle begins. This is not the end of the story…..

When prices hit “affordable levels” buy trades are instigated by computer programs with share prices bouncing extremely quickly. This can happen so quickly, sometimes referred to as a flash sell-off, that private and non-computer program related institutional investors have no time to react.

Arbitrage situations

In years gone by computers were used to identify arbitrage situations where stocks were either too cheap or too expensive compared to similar entities. There were also arbitrage situations where stocks were traded on more than one international stock market. The reality is that arbitrage situations do not lead to flash sell-offs/buying of stocks and simply work on the risk/reward ratio moving out of sync.

So, when we are looking at computer generated trading programs these are very different to arbitrage situations.

Stock markets out of control

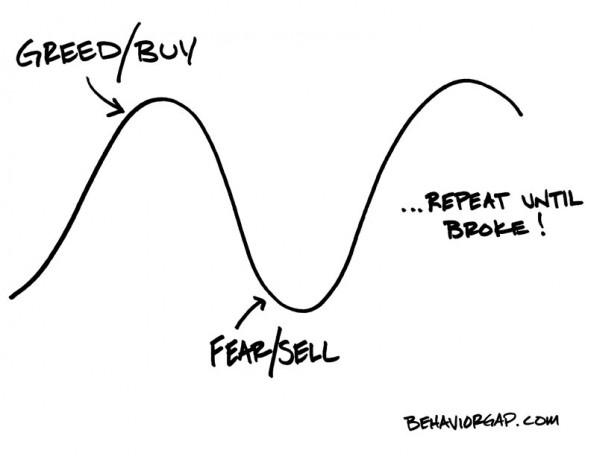

Time and time again the authorities have tried to reduce the impact of computer controlled trading programs. Time and time again there have been short-term hopes of a change only for these to be dashed in the medium to long term. In many ways this type of training takes away the human skill in identifying cheap and expensive stocks. We know that stock markets have in the past relied heavily on human nature, both on the upside and the downside, with periods of exuberance not difficult to find on historic index/share price graphs.

While there is no doubt that criticism of computer related trading programs is justified, what about insider-trading?

Insider-trading

This is a subject which was brought to the attention of many investors in the 1980s by the movie Wall Street. It is fair to say that insider-trading was more out-of-control in the 1980s than it is today. However, we still see share prices moving significantly ahead of major announcements.

The authorities have spent millions upon millions of dollars, hours and hours of time and significant effort trying to tackle insider-trading. The reality is that insider-trading is almost impossible to control. Tittle tattle in the pubs and clubs, to leaks at the printers, not to mention friends of friends buying stock ahead of a big announcement, insider-trading is still rife. While there is no doubt that the authorities do need to continue the fight against insider-trading, as investors, it is possible to use these share price swings to your advantage. If a share price is falling despite “positive reports” in the public domain, what is going on behind the scenes? If a share price continues to rise from an “overbought” position then again, ask yourself what is going on behind-the-scenes. Remember, the trend is your friend…..