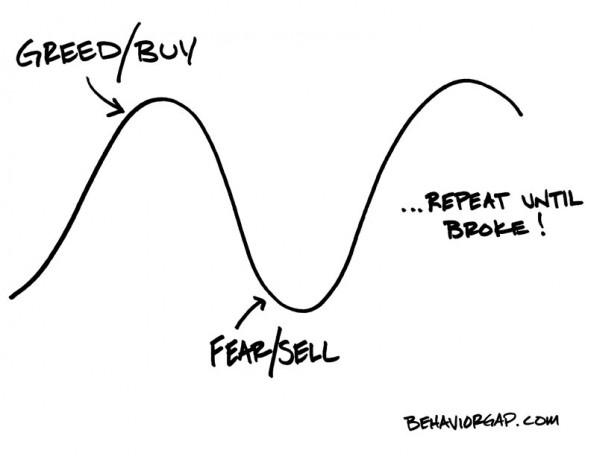

As the US stock market turmoil begins to have a greater impact on Europe and the Far East, many investors are growing concerned about the short to medium term outlook. The tech sector, one which historically attracts a greater premium in terms of ratings in the good times, has seen some of the best names struggling. Amazon, Google, Apple and other leading lights in the US stock market have taken a hit with investors banking profits and content to sit on the sidelines.

Quality stocks will come through

There is every chance we could see more downside in the short to medium term amid a delicate balancing act of investor sentiment and market stability. In reality, if you have a significant profit and markets are tumbling there is nothing wrong with banking a profit and letting markets settle down. Even if you have to buy back your favourite quality stocks at a slightly high-level, knowing the markets have settled, this is not the end of the world. Continue reading “Quality stocks will rise again”