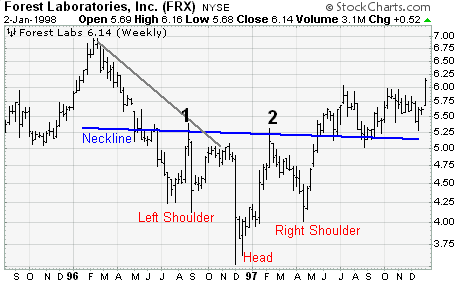

The head and shoulders chart patterns are perhaps the best-known amongst those who use charts as a means of identifying trends. We will now take a look at the head and shoulders top (reversal) as well as the head and shoulders bottom (reversal) which offer similar patterns but a very different direction for the underlying share price.

Head and shoulders top (reversal)

Before a head and shoulders top (reversal) pattern can crystallise there needs to be a significant uptrend in the underlying share price. As the name suggests, the pattern created is similar to a left shoulder, head and right shoulder together with a neckline which offers both support and resistance. Continue reading “Head and shoulders chart patterns”