While there is much negativity surrounding Donald Trump, the president of the USA, stock markets have powered ahead to all-time highs on the back of his presidency. There are high hopes that he will introduce more positive economic policies, protect the US workforce and increase current growth forecasts for the US economy. Currently short-term economic growth is forecast at just below 2% although Donald Trump believes he can increase it to around 4% in due course. However, as we await new economic policies will the much anticipated stock market sell-off become a self-fulfilling prophecy?

What goes up……

At this moment in time it is extremely difficult to call the top of the US market because there is so much positivity surrounding promised economic changes from President Trump. There are high hopes that his business acumen can be translated into economic growth to the benefit of the US population and the US stock market. Valuations are now starting to look a little stretched in some areas, which means there is little room for disappointment as and when the much anticipated economic policies are revealed.

The US stock market will at some point take a breather but even the slightest fallback has recently been taken as a buying opportunity. However, investors are still anticipating a sell-off at some point, but when is anybody’s guess.

Self-fulfilling prophecy

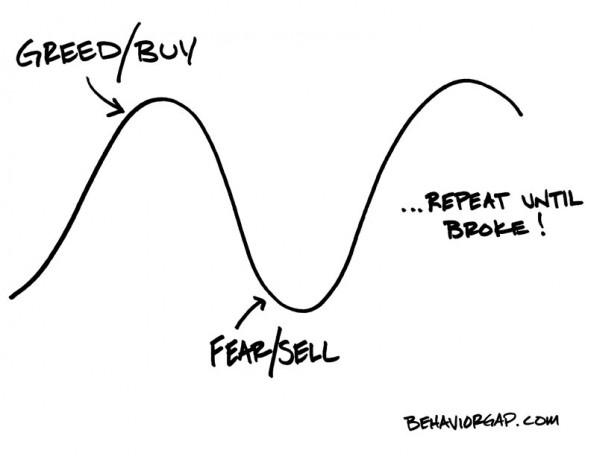

One of the keys to a successful investment career is to sell just before the top of the market, when there are buyers aplenty, and buy just before the bottom, when there are sellers aplenty. This is obviously what would happen in a perfect world but there are signs that some short-term investors are waiting for the much anticipated sell-off. The problem is that if for example a certain level may trigger a sell-off in the minds of some investors then they might try to bail out just before that level. It could turn into a situation where those who are out last need to turn off the lights!

We’re not suggesting that the US market will collapse, indeed there is significant strength behind-the-scenes, but at some point investors will take a profit and it could turn into a short-term correction. The more this is mentioned within investment circles the more it is likely to become a self-fulfilling prophecy and it will just be down to timing.

Consolidation is healthy

While we all enjoy making money when stock markets are flying high, consolidation is healthy because it allows valuations to be reviewed and investors to take a breather. Obviously, as we have mentioned on numerous occasions, stock markets often become overbought and oversold but very quickly these situations balance themselves. There is growing anticipation about an eventual sell-off after the recent strength in the market but so far the Trump honeymoon is just getting longer and longer.

On simple economic indicators, valuations are beginning to look stretched but not to the point where they are dangerous. This does leave little room for disappointment when Donald Trump eventually announces his short, medium and long-term economic plans but he has known this all along. The surprising rise and rise of the US stock market has already caught many investors off guard and no doubt the eventual short-term correction will do the same!