There is an index in the US known as the CBOE Volatility Index which basically monitors option trades in the S&P 500 index. Just this week the index fell to 9.3 which is just above the 8.89 low from December 1993. This indicates that traders are not expecting great volatility in the S&P 500 which is a little strange when you bear in mind the political arena and the prospects for the economy in the short to medium term.

Calm before the storm?

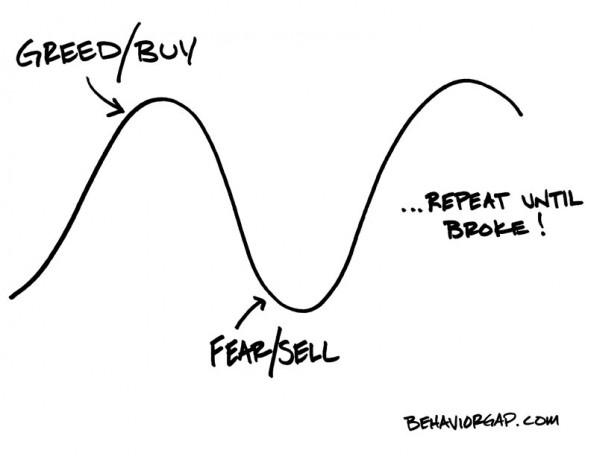

History tells us that when investors contemplate a long-term continuous rise in indices with little in the way of downward volatility there may be a shock round the corner. The fact is that the rise we have seen in the S&P 500 and other US indices cannot continue forever and a day. An awful lot is being taken on trust by US investors and with Donald Trump yet to deliver on an array of his promises, surely there must be scope for some downside?

It is also worth noting that events such as the 1987 worldwide crash and the 2007 US sub-prime mortgage collapse were unforeseen. Just days before the markets turned so-called experts were still expecting further rises even though valuations had been stretched and with the US sub-prime mortgage market, the risks did not warrant the potential rewards.

Never wrong to take a profit

Slowly but surely all of those who doubted the ongoing bull rally in the US stock market have been dragged in kicking and screaming. At this moment in time there is more reputation downside for the so-called experts being out of the market as opposed to being in cash. In a situation which is slightly concerning, nearly all researchers and institutional investors believe there is further upside in the US stock market in the short to medium term. Again, history shows that when the vast majority of people are thinking the same way we could have a shock in store.

While it is never wrong to take a profit, against this current background surely many investors must be considering at least reducing their exposure? We have seen some phenomenal increases in stock prices during the last 12 months with the technology sector leading the way. However, is it indicative of the short to medium term future that the technology market has fallen out of favour a little and recent flotations such as Snapchat are now friendless?

Better to travel than arrive

There is an old saying in the stock market “it is better to travel than arrive” which means do not hang on to your shares until the market arrives at the top and begins to turn downwards. In effect, it may be time to jump out of the vehicle before you get to your final destination!

On a more fundamental basis, over the next 12 months we should see further increases in US base rates, with a knock-on effect to consumer finance and probably more controversy regarding the US economy. Donald Trump is already planning tariffs for steel imports although it is unlikely that overseas steel manufacturers will stand by and let the US dictate the future. Surely there will be a backlash for the US government which could prompt a damaging worldwide trade war and the introduction of yet more tariffs.