Stock markets around the world are in freefall amid serious concerns regarding the coronavirus and its impact on the worldwide economy. We have already seen an array of blue-chip companies warning about their short-term profits as a consequence of coronavirus related issues. Travel restrictions to a lack of component imports from the Far East are now starting to hit companies at the bottom line. So, what can the government do to assist and when will confidence return?

Markets dislike uncertainty

Those who follow the stock market will be fully aware that whatever definitive scenario, it is easy to value assets when taking into account the risk/reward ratio. The problem with the current situation is the uncertainty about how long the coronavirus will continue to spread and how this will impact the worldwide economy. There is also the double whammy of blue-chip companies announcing on a regular basis that they will see short-term problems due to coronavirus related issues such as supply/travel.

So, there is no certainty and as a consequence there is no way of confidently predicting the risk/reward ratio and how long the current situation will continue. Therefore, many investors are taking a worst-case scenario which is why we have seen a serious sell-off in worldwide stock markets.

Is this a sign of things to come?

Over the last decade we have seen various outbreaks of infectious viruses many which have originated from the Far East. While there have been conspiracy theories aplenty the fact is that the coronavirus was expected by the likes of the World Health Organisation (WHO) who referred to this threat as “disease X”. We live in a new era where viruses will be a major threat going forward although slowly but surely governments will learn to react and prepare accordingly.

So, once the coronavirus issue is under control it is unlikely we will see anywhere near the same kind of impact with future virus outbreaks. However, there is a certain degree of uncertainty attached to this statement!

When will markets bottom out?

Ironically, just a couple weeks ago stock markets appeared to be dismissing the threat of the coronavirus and had recovered from initial falls. Suggestions that the rate of infection had “peaked” were encouraging but ultimately well wide of the mark. Interestingly, preparations in the US with regards to the coronavirus threat appear to be limited at best and ill-conceived at worst. This week we learned that Donald Trump had slashed the funding of agencies involved in addressing serious threats such as viruses. As we approach the next presidential election, could this come back to haunt the president?

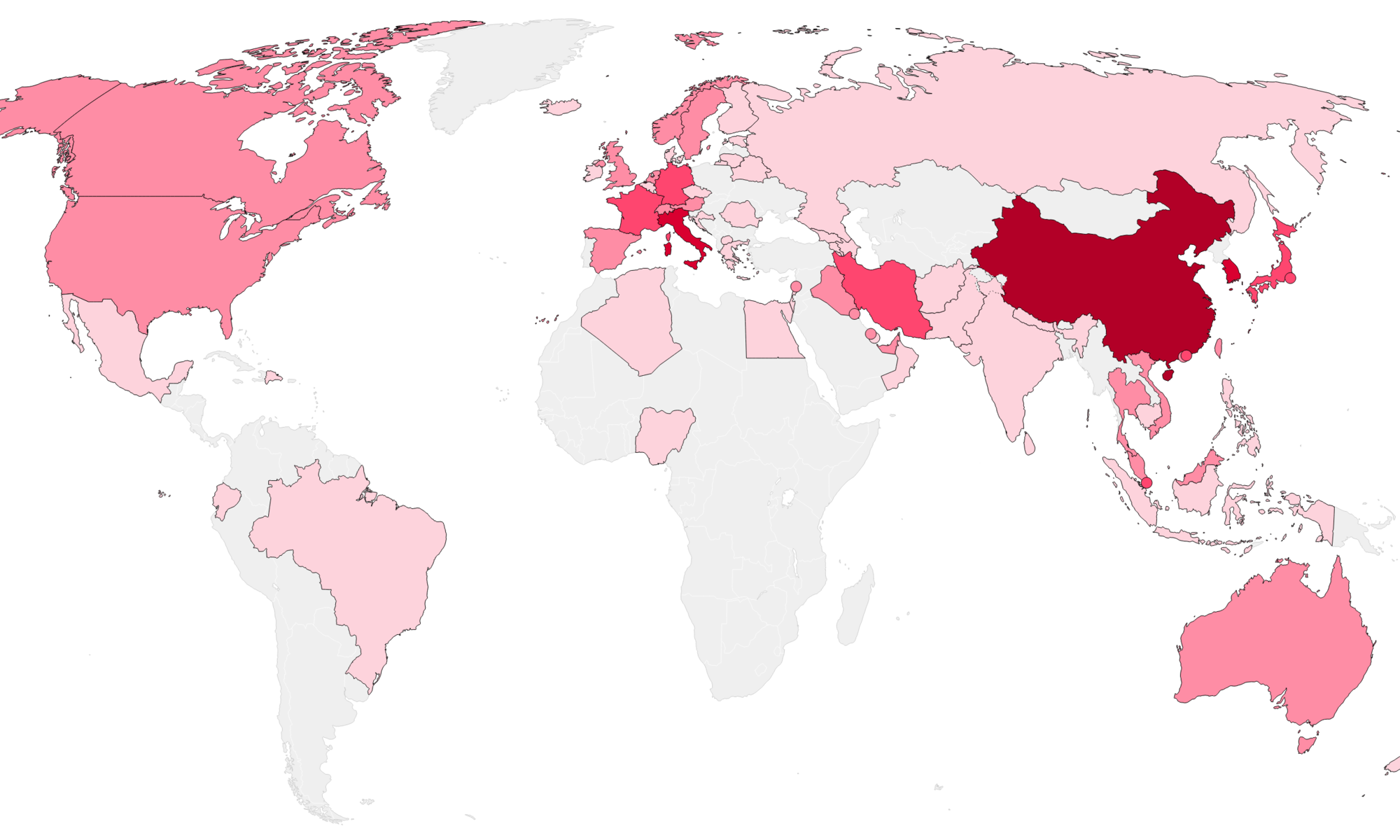

At this moment in time experts believe the situation will get worse before it improves. This seems highly likely with an increase in confirmed infections across the globe. One of the major problems going forward may be the difference in standards of health care across the world with many Third World countries at serious risk of mass infection. Then we have the issue of global travel although it must only be a matter of time before serious restrictions are imposed.

Summary

The best way to summarise the coronavirus issue at the moment is uncertainty……uncertainty with regards to the eventual control, infection rates and deaths. There is also uncertainty with regards to when stock market will eventually recover.